Get This Report about Atlanta Hard Money Lenders

Wiki Article

Some Ideas on Atlanta Hard Money Lenders You Should Know

Table of ContentsSome Known Details About Atlanta Hard Money Lenders Fascination About Atlanta Hard Money LendersThe Basic Principles Of Atlanta Hard Money Lenders Getting My Atlanta Hard Money Lenders To WorkThe Facts About Atlanta Hard Money Lenders RevealedRumored Buzz on Atlanta Hard Money Lenders

In a lot of cases the authorization for the hard cash lending can happen in just someday. The difficult money loan provider is mosting likely to take into consideration the residential property, the amount of deposit or equity the customer will have in the property, the customer's experience (if suitable), the leave strategy for the residential or commercial property and make certain the borrower has some cash gets in order to make the monthly funding settlements.Investor who have not formerly made use of hard cash will certainly be amazed at how swiftly tough cash loans are moneyed contrasted to financial institutions. Contrast that with 30+ days it takes for a financial institution to fund. This speedy funding has saved numerous investor that have been in escrow only to have their original loan provider take out or just not provide.

Their checklist of needs boosts yearly as well as much of them appear arbitrary. Banks likewise have a listing of problems that will increase a red flag and also stop them from also thinking about providing to a consumer such as current repossessions, brief sales, finance alterations, and also insolvencies. Poor credit report is another element that will certainly protect against a financial institution from lending to a customer.

More About Atlanta Hard Money Lenders

Thankfully genuine estate financiers who may currently have several of these problems on their document, difficult money lending institutions are still able to provide to them. The tough cash lenders can provide to customers with issues as long as the consumer has sufficient deposit or equity (at the very least 25-30%) in the property.In the instance of a potential debtor that intends to buy a key home with an owner-occupied hard cash funding through a personal home mortgage loan provider, the customer can originally purchase a home with difficult cash and also then work to fix any type of concerns or wait the required amount of time to get rid of the issues.

Banks are likewise reluctant to give mortgage to customers that are self-employed or currently do not have the needed 2 years of employment history at their existing placement. The consumers may be a perfect prospect for the finance in every various other facet, however these arbitrary demands prevent banks from prolonging financing to the customers.

Not known Facts About Atlanta Hard Money Lenders

When it comes to the borrower without sufficient employment background, they would be able to re-finance out of the difficult money finance as well as into a reduced price standard lending once they acquired the required 2 years at their current setting. Tough money loan providers supply lots of fundings that standard lending institutions such as banks have no rate of interest in funding.

These tasks entail an investor acquiring a home with a brief term financing to ensure that the investor can quickly make the required fixings and updates and also then offer the property. atlanta hard money lenders. In many cases, the real estate financier just needs an one year finance. Banks desire to lend money for the long-term as well as more than happy to make a little quantity of passion over an extended period of time.

The problems might be associated with structure, electric or plumbing as well as could create the financial institution to take into consideration the building uninhabitable as well as not able to be moneyed. and are incapable to think about a lending circumstance that is outside of their stringent lending requirements. A tough cash lending institution would have the ability to offer a debtor with a finance to acquire a property that has concerns preventing it from qualifying for a standard small business loan.

Atlanta Hard Money Lenders Things To Know Before You Get This

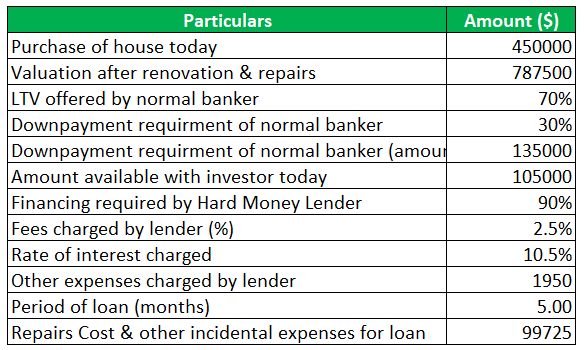

Difficult money lenders additionally charge a finance source fee which are called factors, a portion of the funding amount. atlanta hard money lenders. Factors typically range from 2-4 although there are loan providers that will charge a lot higher points for certain circumstances. Specific areas of the country have several competing tough money lending institutions while various other locations have few.

In large cities there are typically much more difficult cash lenders eager to provide than in even more remote backwoods. Debtors can benefit considerably from inspecting rates at a couple of various loan providers prior to devoting to a hard money loan provider. While not all tough money lending institutions offer 2nd mortgages or depend on acts on properties, the ones who do charge a higher rate of interest price on 2nds than on 1sts.

Get This Report about Atlanta Hard Money Lenders

This boosted passion price shows the raised threat for the loan provider being in 2nd see post setting instead of 1st. If the customer goes into default, the 1st lien holder can seize on the residential property and also eliminate the 2nd lien owner's rate of interest in the home. Longer regards to 3-5 years are readily available however that is usually the top restriction for car loan term size.If rates of interest drop, the consumer has the choice of re-financing to the lower current rates. If the rate of interest raise, the customer has the ability to keep their lower rate of interest financing as well as lending institution is forced to wait up until the loan becomes due. While the lending institution is waiting for the loan to end up being due, their investment in the depend on action is generating less click to read than what they can receive for a brand-new depend on deed financial investment at existing rates.

See This Report about Atlanta Hard Money Lenders

This is a worst case scenario for the hard money lender. In a similar situation where the debtor puts in a 30% down repayment (rather of only 5%), a 10% decrease in the atlanta hard money lenders value of the property still offers the borrower lots of reward to stick with the property and also task to safeguard their equity.Report this wiki page